Golden Matrix Group (Nasdaq: GMGI) has experienced its share of market fluctuations, but for investors with a long-term outlook, the company’s recent Q2 2024 results provide a compelling case for continued growth. Despite any short-term noise, GMGI is solidifying its position in the rapidly expanding global gaming market, and the numbers back up this optimism. Here’s why:

Key Highlights

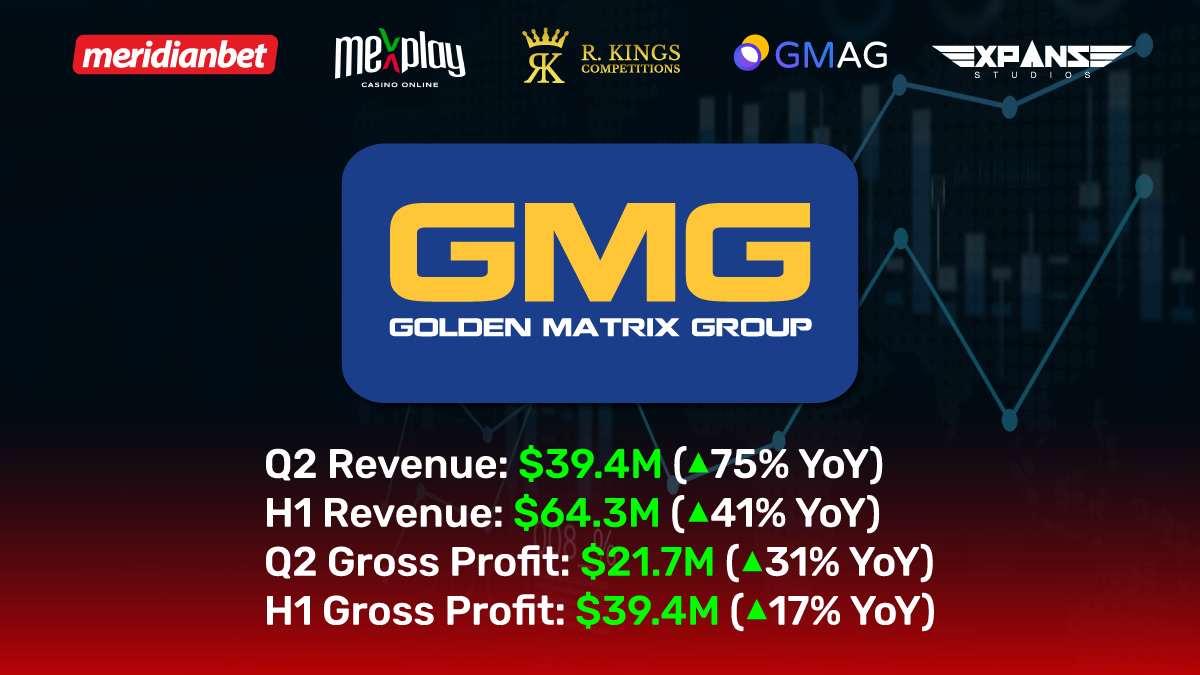

- Q2 Revenue Growth: $39.4 million in Q2 2024, a 75% increase year-over-year.

- H1 Revenue: $64.3 million, reflecting a 41% increase compared to H1 2023.

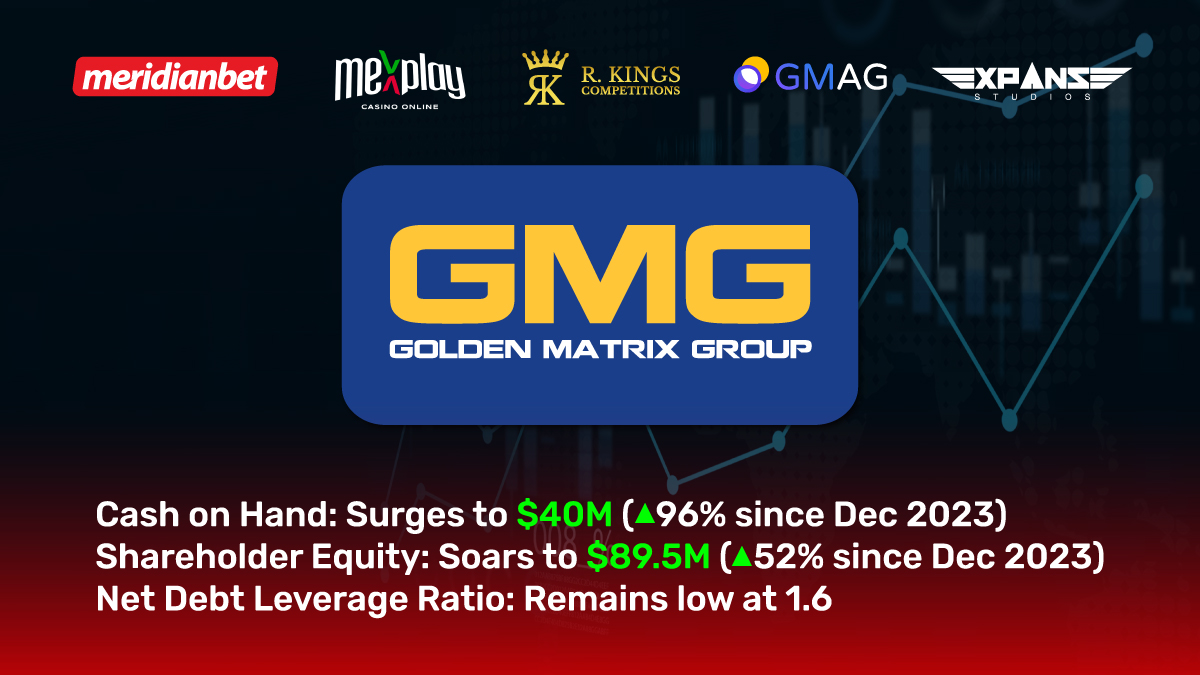

- Cash on Hand: Surged to over $40 million, a 96% increase since December 2023.

- Shareholder Equity: Grew by 52% to $89.5 million, reinforcing financial stability.

- Expanding Revenue and Market Share in a Competitive Industry

On August 13, GMGI reported Q2 2024 consolidated revenues of $39.4 million, a remarkable 75% increase year-over-year. This growth comes on the heels of GMGI’s strategic acquisition of Meridianbet, which has allowed the company to enhance its global footprint significantly. Year-to-date revenues now stand at $64.3 million, reflecting a 41% increase compared to H1 2023.

The company’s ability to expand its market share in a competitive environment is clear. Meridianbet, a key subsidiary, continues to perform strongly across its 17 jurisdictions in Europe, Africa, and South America. Meanwhile, other brands under the GMGI umbrella, such as Expanse Studios and RKings, have also seen impressive growth, contributing to the group’s overall success.

Broadening the Portfolio with Strategic Brands

Alongside Meridianbet, GMGI’s portfolio includes RKings, a leading prize awards business in the UK and Ireland, which saw revenues increase by over 43% year-over-year in Q2. The company’s growing presence in the Latin American market is further strengthened by Mexplay, an online casino platform gaining traction in Mexico. Additionally, GMAG, GMGI’s B2B aggregator gaming platform, now serves over 2 million registered players, solidifying the company’s position as a diversified gaming powerhouse.

Expanse Studios: Entering the U.S. Market and Expanding Across Europe

Expanse Studios is making significant strides in expanding its market presence, particularly with its entry into the U.S. iGaming market. The studio is currently in the process of applying for the New Jersey Casino Service Industry Enterprise license, with the application process well underway and awaiting final confirmation. Additionally, Expanse Studios has secured a license for the Bulgarian market and is actively pursuing licenses in Croatia and Romania, key markets that will further expand its European footprint. In Q2 2024, Expanse Studios achieved a 30% revenue increase compared to Q1 2024. This momentum is further supported by the studio’s high-profile participation in major industry events, such as Sigma Americas in São Paulo, SBC North America in New Jersey, and Sigma Asia in Manila, along with the completion of its integration with SoftSwiss.

Strategic Investments in Innovation and Market Expansion

A hallmark of GMGI’s strategy is its commitment to innovation and strategic market entries. The introduction of AI-powered tools like the Casino Game Recommender is already paying dividends, with a 3% increase in player engagement and a 9% boost in new game adoption. These innovations are making a real difference in how GMGI connects with its customers, giving the company a competitive edge.

Moreover, GMGI’s expansion into new markets, including Brazil, Peru, and South Africa, is a critical component of its long-term growth strategy. The Brazilian market alone has a projected $20 billion potential.

Balancing Short-Term Challenges with Long-Term Gains

Like any growth company, GMGI faces short-term challenges, but it’s clear that the company is playing the long game. The recent integration of Meridianbet has brought about additional costs, but these are strategic investments designed to position GMGI for future success. Despite these costs, the company maintained a solid adjusted EBITDA of $5 million in Q2, aligning with its expectations.

GMGI’s financial health remains strong, with cash on hand surging to over $40 million—a 96% increase since December 2023. Shareholder equity also saw a significant rise, growing by 52% to $89.5 million. These figures underscore GMGI’s ability to navigate the current economic landscape while preparing for sustained long-term growth.

Why GMGI Is a Long-Term Play

Investors looking for a growth stock with the potential to deliver substantial returns over the long term should consider GMGI. The company’s strategic market expansions, innovative product offerings, and robust financial performance make it a compelling choice for those willing to ride the waves of market volatility.

GMGI’s ability to secure new licenses in key markets and invest in technology that enhances player engagement speaks to its commitment to staying ahead in a rapidly evolving industry. As the company continues to expand and innovate, it’s well-positioned to deliver strong returns for investors who are in it for the long haul.

While short-term fluctuations are inevitable, the bigger picture for GMGI is one of sustained growth and value creation. The recent Q2 results are just the beginning of what promises to be an exciting journey for this global gaming leader.

Disclaimer

This is information – not financial advice or recommendation.

The content and materials featured or linked to on GamblingIndustryNews.com are for your information and education only and are not attended to address your particular personal requirements.

The information does not constitute financial advice or recommendation and should not be considered as such. GamblingIndustryNews.com is not regulated by the Financial Conduct Authority (FCA), it’s authors are not financial advisors and it is therefore not authorised to offer financial advice.

Do your own research and seek independent advice when required

Always do your own research and seek independent financial advice when required. Any arrangement made between you and any third party named or linked to from the site is at your sole risk and responsibility. Creative Money and its associated writers assume no liability for your actions.

Investing carries risks

The value of investments and any income derived from them can fall as well as rise and you may not get back the original amount you invested.

Golden Matrix Group (GMGI) has recently reported strong second quarter results, further solidifying its position as a leading long-term growth stock in the technology sector. The company, which specializes in providing innovative gaming solutions for the online gambling industry, has seen significant growth in revenue and profitability in recent months.

One of the key highlights of GMGI’s Q2 results is its impressive revenue growth, which increased by over 50% compared to the same period last year. This growth can be attributed to the company’s successful expansion into new markets, as well as its ability to attract a larger customer base. GMGI’s focus on developing cutting-edge technology and providing top-notch customer service has also played a significant role in driving revenue growth.

In addition to strong revenue growth, GMGI also reported a substantial increase in profitability during the second quarter. The company’s net income more than doubled compared to the previous year, reflecting its ability to effectively manage costs and improve operational efficiency. This strong financial performance is a clear indicator of GMGI’s solid business fundamentals and its potential for long-term growth.

Furthermore, GMGI’s strong Q2 results have been well-received by investors, with the company’s stock price experiencing a significant increase following the earnings announcement. This positive market reaction highlights the confidence that investors have in GMGI’s growth prospects and its ability to deliver value to shareholders.

Looking ahead, GMGI remains focused on expanding its presence in key markets and continuing to innovate in order to stay ahead of the competition. With a solid track record of growth and profitability, as well as a strong market position in the online gambling industry, GMGI is well-positioned to deliver long-term value for investors and maintain its status as a leading growth stock in the technology sector.